SOLUTIONS

Trust & Estate

Planning Services

We’ve simplified the process of achieving unparalleled asset protection, privacy, and tax benefits, ensuring that your legacy is safeguarded for generations to come.

1. TrustDraft: Business Formation & Documentation

"Vermilion Vitez: Crafting Secure Trusts & Foundations for Protection, Privacy, Tax Savings – Build Your Lasting Legacy with Faith and Transparency."

2. Personalized Client Analysis: Meeting Your Unique Requirements

"At Vermilion Vitez, we deliver tailored consultations on estate planning, Wyoming LLC setups, and credit strategies—empowering accredited investors and faith-based groups to build ethical, independent legacies with asset protection and tax efficiency."

3.Protect your Assets With a Tailored Strategy

"Vermilion Vitez: Shield Your Assets from Creditors with Entity Layering, SPC Trusts, Private Foundations, Real Estate Investments—and Educational Tools for Enduring Legacy Protection."

Focusing on

What's Important to You

Our experienced team offers full trust services, including advice, setup, and management. We help organize your estate to increase its value and reduce stress for your family and heirs.

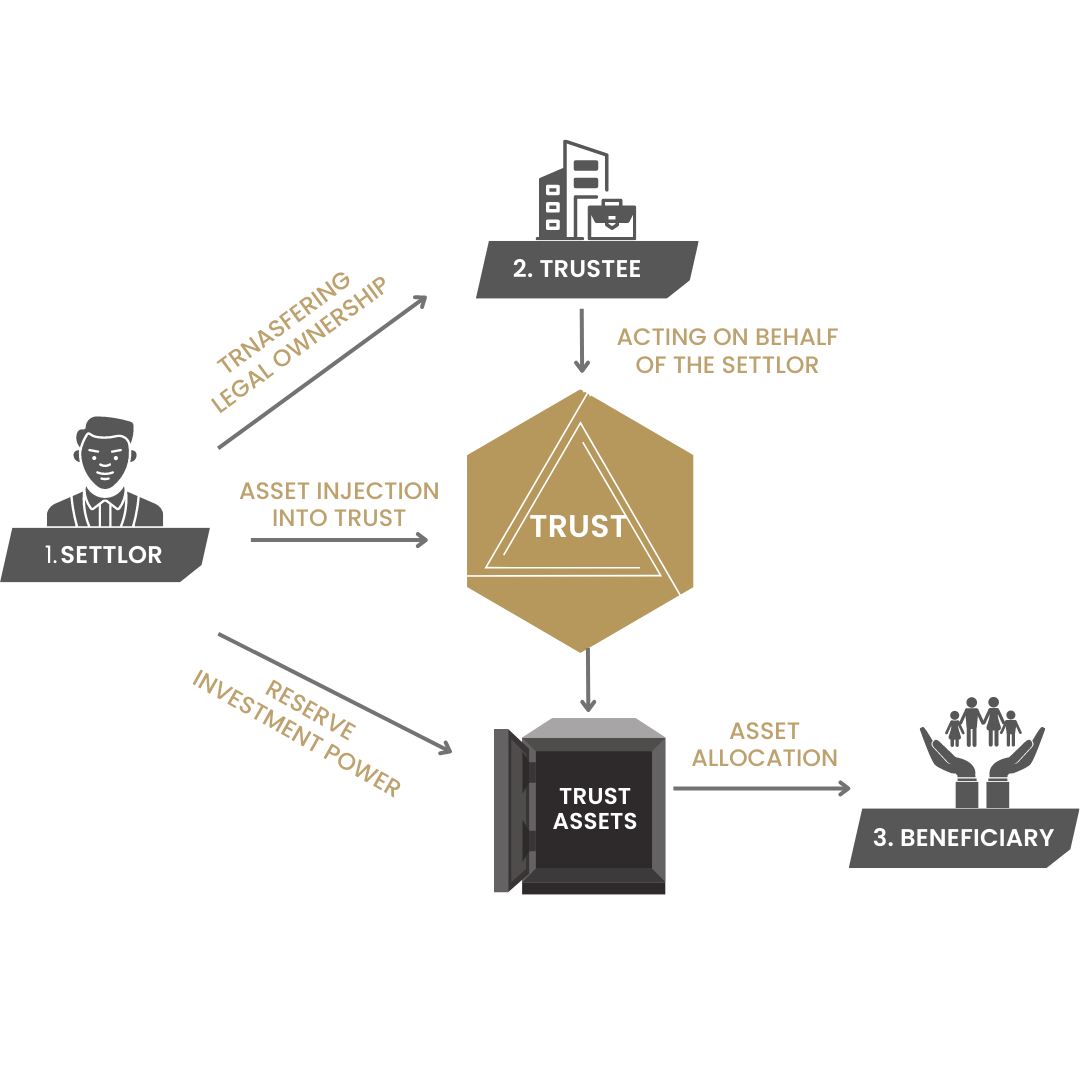

Choosing Vermilion Vitez Trust Solutions means leveraging one of the most powerful tools in estate planning: The Private Irrevocable Trust.

Provide unparalleled asset protection

Deliver significant tax advantages

Enhance client privacy

Offer personalized, cost-effective estate planning solutions

Surpass traditional firms and generic online templates in service quality

Employ an exclusive, hands-on approach for trust creation and updates

Ensure a seamless and stress-free Private Trust establishment process

Grant access to expert guidance and innovative strategies

Utilize a dedicated platform to simplify estate planning

Safeguard clients’ legacy for generations to come

TAILORED TRUST SOLUTIONS

For Every Need

Estate planning is more than just managing assets – it’s about securing your family’s future for generations to come. With extensive knowledge of Grantor Trusts (GT) , Unincorporated Business Organization Trust (UBOT), SPC Trust, Private Foundations and other tax-efficient wealth transfer strategies, our team will help craft a plan that aligns with your unique vision.

Take control of your legacy today—protect your family and wealth with ease.

*

Take control of your legacy today—protect your family and wealth with ease. *

IN THE SPOTLIGHT

Wealth

Planning for

the Solo Individual

Single individuals—whether never married, divorced, or widowed—encounter distinct hurdles in estate planning, wealth transfer tax tactics, and end-of-life choices. That's why solo wealth strategies are a vital step forward, offering a prime chance to shape a legacy that aligns with your core beliefs, charitable ambitions, and ongoing financial protection.